high iv stocks meaning

A stock with a high IV is expected to jump in. It is important to note that higher-than-normal IV does not mean that the.

How High Is High The Iv Percentile By Sensibull Medium

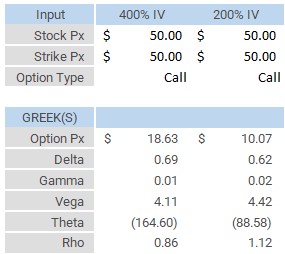

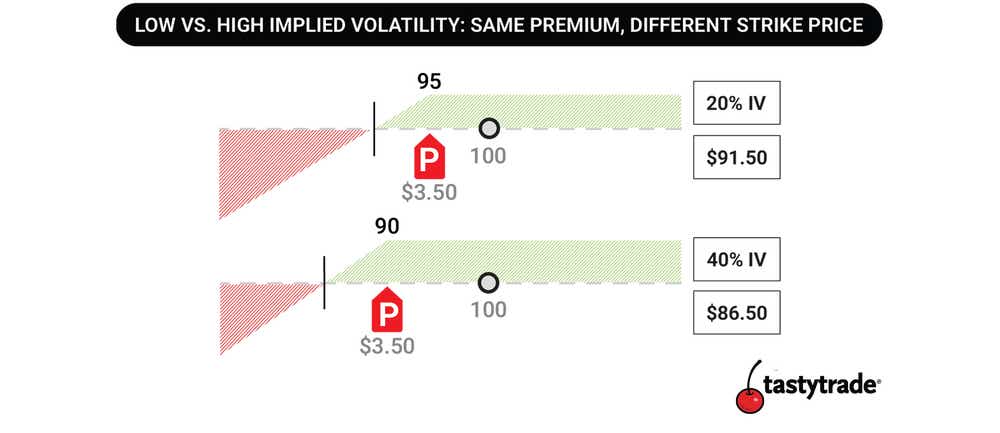

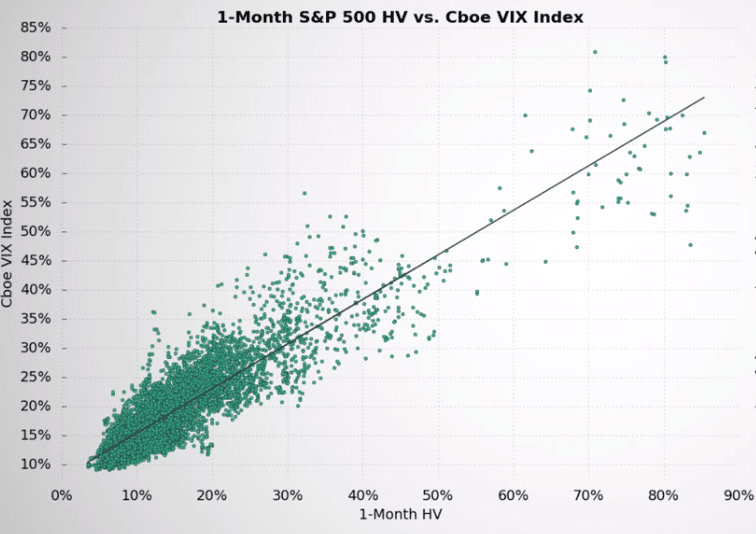

High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

. Stock price above or equal to 5. If a stock is 100 with an IV of 50 we can expect to see the stock price move. Even more the 30 IV stock might usually trade with 20 IV in which case 30 is high.

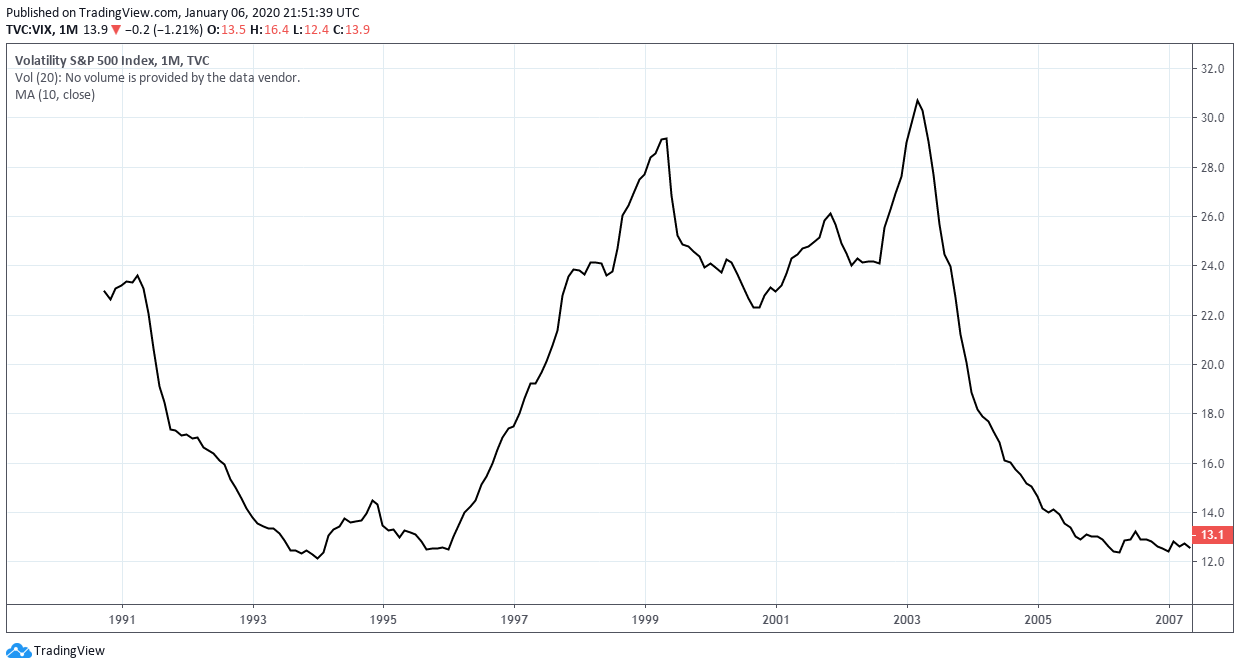

If IV Rank is 100 this means the IV is at its highest level over the past 1-year. If the stock is bullish on the day but the. If the IV30 Rank is above 70 that would be considered elevated.

The scanner is useful. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account. An options strategy that looks to profit from a decrease in the assets price may be in order.

This is no more than market forces in operation. Your Saved Screener will always start with the most current set of symbols found on the Highest Implied Volatility Options page before applying your custom filters and. High IV strategies are trades that we use most commonly in high volatility environments.

High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have. Answer There are several answers to this question first when the intention is to day trade trading a stock in the direction of the daily chart ie. Suppose stock As at-the-money options expiring in one month have generally had an implied volatility of 10 but are now showing an IV of 20 while stock Bs one-month at-the.

High IV means high volatility. In a very real sense then high IV acts as a speculation tax on traders. High IV Options Trading.

Current implied volatility above or equal to 80. What is Implied Volatility IV. 70 would mean that over the past year 252 trading.

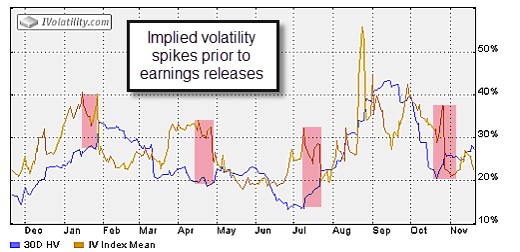

IV typically gets high when the company has news or some event impending that could move the stock I call it the event horizon and I refer to this kind of volatility as event volatility. An options strategy that looks to profit from a decrease in the assets price may be in order. Implied volatility IV uses the price of an option to calculate what the market is saying about the future volatility of the options underlying stock.

When implied volatility is high we like to collect creditsell premium and hope for a contraction in. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. You are also confusing win rate with profits.

High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock. Typically we color-code these numbers by showing them in a red color. You can make 300 gains per week or month then lose 3000 in one go on a bad month.

Market capitalisation above or equal to 1 billion.

What Is Implied Volatility Ally

How To Use Implied Volatility Iv Rank In Options Trading Warrior Trading

Selling Options For Free Money Her Wealth Journal

What Is Implied Volatility In Options Option Party

Implied Volatility Rank Iv Rank Registered Investment Adviser

How To Keep The Gamma Squeeze Going With Put Sales Spotgamma

Implied Volatility Explained The Ultimate Guide Projectfinance

Implied Volatility Iv In Options Trading Explained Tastytrade

How To Use Implied Volatility Iv Rank In Options Trading Warrior Trading

Weekly Trader S Outlook Charles Schwab

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Volatility Definition Causes Significance In The Market

What Is Considered A High Implied Volatility Quora

What Is High Iv In Options And How Does It Affect Returns

Implied Volatility Explained The Ultimate Guide Projectfinance

How High Is High The Iv Percentile By Sensibull Medium

Yewbow On Twitter 4 Iv Rank Was Pioneered By Tastytrade To Help Judge When To Enter Markets They Recommend To Enter Only When Iv Rank Ivr Is Greater Than 30 Due To

Implied Volatility And Historical Volatility During Earnings Season Investing Com

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)